How To Record Job Retention In Accounting . many companies have the opportunity to take advantage of the employee retention tax credit until 2025, but it’s crucial that they procure and submit the necessary. The total amount relating to a contract needs to be included as income on. the first step to recording the employee retention credit in your accounting software is to record your original. how are retentions accounted for? this report addresses the financial reporting considerations related to the employee retention credit. accounting for employee retention credits. Add retainage receivable to the quickbooks chart of accounts. how to record & track retainage in quickbooks.

from tax.modifiyegaraj.com

many companies have the opportunity to take advantage of the employee retention tax credit until 2025, but it’s crucial that they procure and submit the necessary. this report addresses the financial reporting considerations related to the employee retention credit. the first step to recording the employee retention credit in your accounting software is to record your original. Add retainage receivable to the quickbooks chart of accounts. accounting for employee retention credits. how to record & track retainage in quickbooks. The total amount relating to a contract needs to be included as income on. how are retentions accounted for?

How To Record Employee Retention Credit In Accounting TAX

How To Record Job Retention In Accounting The total amount relating to a contract needs to be included as income on. The total amount relating to a contract needs to be included as income on. this report addresses the financial reporting considerations related to the employee retention credit. the first step to recording the employee retention credit in your accounting software is to record your original. many companies have the opportunity to take advantage of the employee retention tax credit until 2025, but it’s crucial that they procure and submit the necessary. how are retentions accounted for? Add retainage receivable to the quickbooks chart of accounts. how to record & track retainage in quickbooks. accounting for employee retention credits.

From www.ecsfinancial.com

Records Retention What Should You Keep and For How Long? How To Record Job Retention In Accounting accounting for employee retention credits. this report addresses the financial reporting considerations related to the employee retention credit. The total amount relating to a contract needs to be included as income on. how to record & track retainage in quickbooks. Add retainage receivable to the quickbooks chart of accounts. how are retentions accounted for? the. How To Record Job Retention In Accounting.

From www.assurx.com

Record Retention Management Policies It’s All in the Timing Whitepaper How To Record Job Retention In Accounting how are retentions accounted for? this report addresses the financial reporting considerations related to the employee retention credit. the first step to recording the employee retention credit in your accounting software is to record your original. accounting for employee retention credits. many companies have the opportunity to take advantage of the employee retention tax credit. How To Record Job Retention In Accounting.

From www.excelstemplates.com

Record Retention Schedule Templates 11+ Free Docs, Xlsx & PDF Formats How To Record Job Retention In Accounting this report addresses the financial reporting considerations related to the employee retention credit. the first step to recording the employee retention credit in your accounting software is to record your original. Add retainage receivable to the quickbooks chart of accounts. how are retentions accounted for? The total amount relating to a contract needs to be included as. How To Record Job Retention In Accounting.

From www.youtube.com

How to treat retention amount in accounting Complete journal Entries How To Record Job Retention In Accounting accounting for employee retention credits. many companies have the opportunity to take advantage of the employee retention tax credit until 2025, but it’s crucial that they procure and submit the necessary. the first step to recording the employee retention credit in your accounting software is to record your original. The total amount relating to a contract needs. How To Record Job Retention In Accounting.

From www.mgocpa.com

How to Account for the Employee Retention Credit MGOCPA How To Record Job Retention In Accounting Add retainage receivable to the quickbooks chart of accounts. how are retentions accounted for? accounting for employee retention credits. this report addresses the financial reporting considerations related to the employee retention credit. many companies have the opportunity to take advantage of the employee retention tax credit until 2025, but it’s crucial that they procure and submit. How To Record Job Retention In Accounting.

From www.excelstemplates.com

Record Retention Schedule Templates 11+ Free Docs, Xlsx & PDF Formats How To Record Job Retention In Accounting many companies have the opportunity to take advantage of the employee retention tax credit until 2025, but it’s crucial that they procure and submit the necessary. how to record & track retainage in quickbooks. Add retainage receivable to the quickbooks chart of accounts. this report addresses the financial reporting considerations related to the employee retention credit. . How To Record Job Retention In Accounting.

From www.saviom.com

Retention Strategies in Audit & Accounting Firms How To Record Job Retention In Accounting the first step to recording the employee retention credit in your accounting software is to record your original. how are retentions accounted for? many companies have the opportunity to take advantage of the employee retention tax credit until 2025, but it’s crucial that they procure and submit the necessary. accounting for employee retention credits. The total. How To Record Job Retention In Accounting.

From www.excelstemplates.com

Record Retention Schedule Templates 11+ Free Docs, Xlsx & PDF Formats How To Record Job Retention In Accounting how are retentions accounted for? Add retainage receivable to the quickbooks chart of accounts. the first step to recording the employee retention credit in your accounting software is to record your original. this report addresses the financial reporting considerations related to the employee retention credit. The total amount relating to a contract needs to be included as. How To Record Job Retention In Accounting.

From corodata.com

Business Record Retention Guidelines Get The Free Guide How To Record Job Retention In Accounting Add retainage receivable to the quickbooks chart of accounts. this report addresses the financial reporting considerations related to the employee retention credit. how are retentions accounted for? The total amount relating to a contract needs to be included as income on. many companies have the opportunity to take advantage of the employee retention tax credit until 2025,. How To Record Job Retention In Accounting.

From www.brighthr.com

Employee Record Retention BrightHR How To Record Job Retention In Accounting accounting for employee retention credits. Add retainage receivable to the quickbooks chart of accounts. how are retentions accounted for? the first step to recording the employee retention credit in your accounting software is to record your original. this report addresses the financial reporting considerations related to the employee retention credit. The total amount relating to a. How To Record Job Retention In Accounting.

From corodata.com

Creating a Record Retention Schedule + Policy Download How To Record Job Retention In Accounting Add retainage receivable to the quickbooks chart of accounts. many companies have the opportunity to take advantage of the employee retention tax credit until 2025, but it’s crucial that they procure and submit the necessary. this report addresses the financial reporting considerations related to the employee retention credit. the first step to recording the employee retention credit. How To Record Job Retention In Accounting.

From www.linkadvisors.com.au

Guide to Accounting for Retention Payment in the Building How To Record Job Retention In Accounting accounting for employee retention credits. the first step to recording the employee retention credit in your accounting software is to record your original. The total amount relating to a contract needs to be included as income on. how are retentions accounted for? Add retainage receivable to the quickbooks chart of accounts. many companies have the opportunity. How To Record Job Retention In Accounting.

From cetkrtcb.blob.core.windows.net

Accounting Record Retention Requirements at Raymond Shephard blog How To Record Job Retention In Accounting how are retentions accounted for? accounting for employee retention credits. this report addresses the financial reporting considerations related to the employee retention credit. how to record & track retainage in quickbooks. many companies have the opportunity to take advantage of the employee retention tax credit until 2025, but it’s crucial that they procure and submit. How To Record Job Retention In Accounting.

From bceweb.org

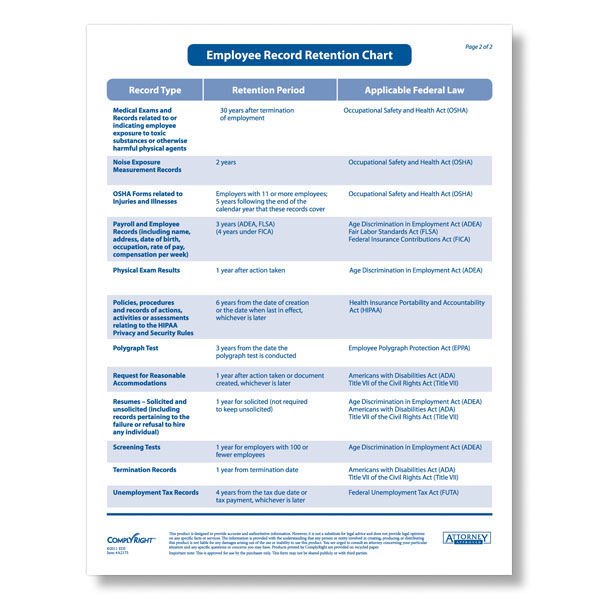

Business Record Retention Chart A Visual Reference of Charts Chart How To Record Job Retention In Accounting accounting for employee retention credits. how to record & track retainage in quickbooks. The total amount relating to a contract needs to be included as income on. many companies have the opportunity to take advantage of the employee retention tax credit until 2025, but it’s crucial that they procure and submit the necessary. Add retainage receivable to. How To Record Job Retention In Accounting.

From www.slideserve.com

PPT RECORD RETENTION PowerPoint Presentation, free download ID6408078 How To Record Job Retention In Accounting the first step to recording the employee retention credit in your accounting software is to record your original. The total amount relating to a contract needs to be included as income on. many companies have the opportunity to take advantage of the employee retention tax credit until 2025, but it’s crucial that they procure and submit the necessary.. How To Record Job Retention In Accounting.

From www.tradepub.com

Record Retention Schedule Guidelines For Every Office Document Free Report How To Record Job Retention In Accounting the first step to recording the employee retention credit in your accounting software is to record your original. many companies have the opportunity to take advantage of the employee retention tax credit until 2025, but it’s crucial that they procure and submit the necessary. Add retainage receivable to the quickbooks chart of accounts. how are retentions accounted. How To Record Job Retention In Accounting.

From www.disasterloanadvisors.com

How to Report Employee Retention Credit on Financial Statements How To Record Job Retention In Accounting The total amount relating to a contract needs to be included as income on. the first step to recording the employee retention credit in your accounting software is to record your original. how to record & track retainage in quickbooks. many companies have the opportunity to take advantage of the employee retention tax credit until 2025, but. How To Record Job Retention In Accounting.

From www.slideshare.net

Records Retention Scheduling How To Record Job Retention In Accounting many companies have the opportunity to take advantage of the employee retention tax credit until 2025, but it’s crucial that they procure and submit the necessary. Add retainage receivable to the quickbooks chart of accounts. the first step to recording the employee retention credit in your accounting software is to record your original. how to record &. How To Record Job Retention In Accounting.